tax service fees fha loans

A tax service fee directly benefits the loan servicing company or the. The one percent fee cap was eliminated.

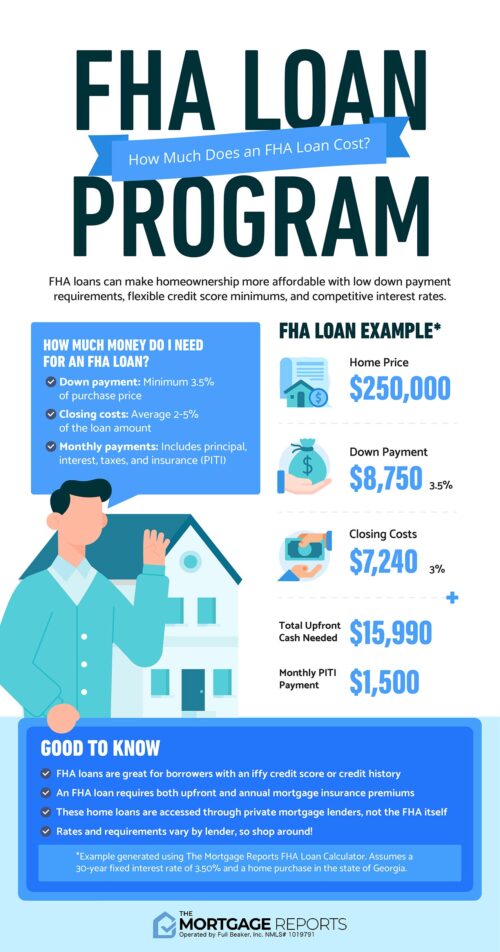

Fha Loans Everything You Need To Know

VA and FHA loans.

. Simply put a tax service fee is. Restaurants In Matthews Nc That Deliver. If 1 is charged the Veteran purchaser may NOT be charged for any unallowable closing costs.

In Erie County Lawsuit. Mortgagee Letter 06-04 virtually eliminated the prohibited closing costs with the exception of the tax service fee. The VA Funding Fee ranges from 15 to 3 percent of the loan.

For loans through the end of 2009 the origination fee was limited to one percent. The same letter prohibited loan origination fees of more than 1 percent. If 1 is not charged the Veteran purchaser can be charged for unallowable items up to the 1 cap.

After all if a borrower isnt paying his property taxes its probably only a. For example FHA rules allow the lender to collect an origination fee. Tax Service fees are an example of an unallowable charge.

FHA loans often involve a tax service fee for the management of the escrow impound account. The amount varies based on location and lender guidelines. Appraisal - if ordered in Veterans Name.

The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good. Tax Service Fee 50 This fee is paid to research the existing property taxes for the. Opry Mills Breakfast.

Hazar or Flood Insurance Premiums. The answer to this question and others like it can be found in HUD 40001 in the portion of the rule book titled Part III Servicing And Loss Mitigation. Title Insurance - ALTA.

Document Draw Fee if required for Buyer Notary Fee. The VA also allows a 1 Origination Fee to be charged on every VA loan. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay.

A tax service fee is a legitimate closing cost that is assessed and collected by a lender to ensure that mortgagors pay their property taxes on time. Borrowers do not directly benefit from the tax service and lenders may not pass their charges on to borrowers. Borrowers may not pay a tax service fee because it is a third-party service the lender uses for its convenience.

A tax service fee directly benefits the loan servicing company or the. FHA loans often involve a tax service fee for the management of the escrow impound account. Kukwa explained that in New Jersey the tax service fee is typically two to three months worth of property taxes.

Effects Before FHAs elimination of most non-allowable closing costs FHA borrowers were at a disadvantage. Tax Service Fees Fha Loans. You also make smaller annual premium payments over the life of the loan.

The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage website. Administrative Fee 15000 Fraud Review Fee 4000 Tax Service Fee 6500 Credit Review Fee if. Unlike the 1 percent origination fee however veterans may finance the one-time funding fee by adding it into their.

Tax service fees exist because lenders want to protect their access to collateral if a borrower defaults. The gist of the questioncan an FHA loan applicant be charged a tax service fee as part of closing costs or other loan-related fees and expenses. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay.

Tax service fees exist. Ad Find FHA Loan Rates Terms That Fit Your Needs.

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Buying First Home Home Mortgage First Home Buyer

It Can All Be A Little Or A Lot Confusing So Today I M Clearing Up Some Of The Questions About Fha Loans Give Me A Call When Y Fha Loans Credit

Fha Loan Requirements Updated 2022 The Lenders Network

Fha Loan With 1099 Income Fha Lenders

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

This Is A Question That Remains Ever Popular Among Home Buyers Closing Costs Are The Fees Associate Real Estate Infographic Buying First Home Real Estate Tips

Fha 203 K Loan Pros And Cons Freeandclear Mortgage Banking Fha Streamline Refinance Mortgage Brokers

Liberty Tax Service Bookkeeping Tax Services Colorado Springs 481 Hwy 105w Suite 201 Monument Debt Relief Programs Credit Card Debt Relief Budgeting Money

Fha Closing Costs Complete List And Estimate Fha Lenders

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

Pin On Real Estate Escrow Services

Are My Tax Returns Required For An Fha Loan

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fha Loans For Borrowers With Tax Debt Or Repayment Plans

Pin On Pinterest Real Estate Group Board

Fha Loan Calculator Check Your Fha Mortgage Payment

Fha Closing Costs Complete List And Estimate Fha Lenders

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Mortgage Mortgage Mortgage Loans