is property transfer tax included in mortgage

1 if the first 200000 of the propertys fair market value plus 2 of the value portion between 200000 2000000 plus 3 tax on. Land buildings furniture and fixtures transportation equipment machinery and other equipment and inventories.

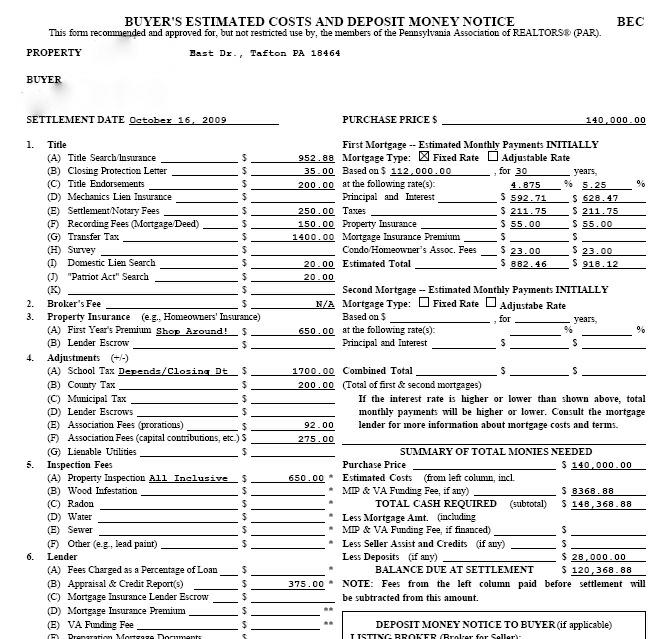

Understanding Transfer Taxes During A Home Sale Altius Mortgage

The general property transfer tax rate is.

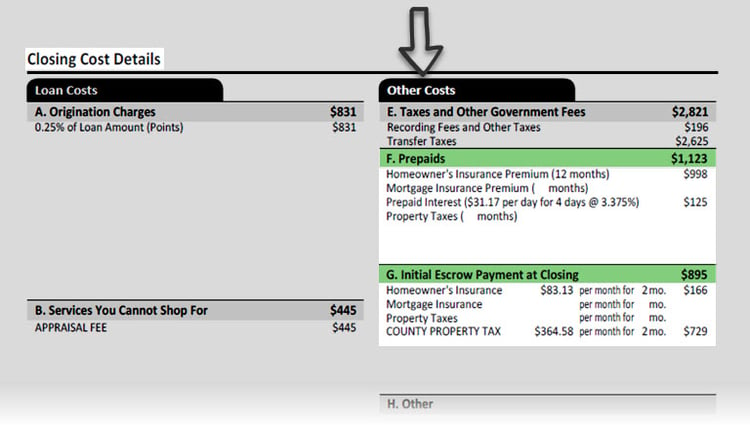

. The amount each homeowner pays per year varies depending on. In this case expect to pay a total of 025 per 100 in taxes and. The average transfer tax is 1 to 3 per 1000 of the sales price but some areas add additional transfer taxes on top of the base costs.

Include only property that is. The general property transfer tax rate is. Further for all other types of transfers in Miami-Dade County there.

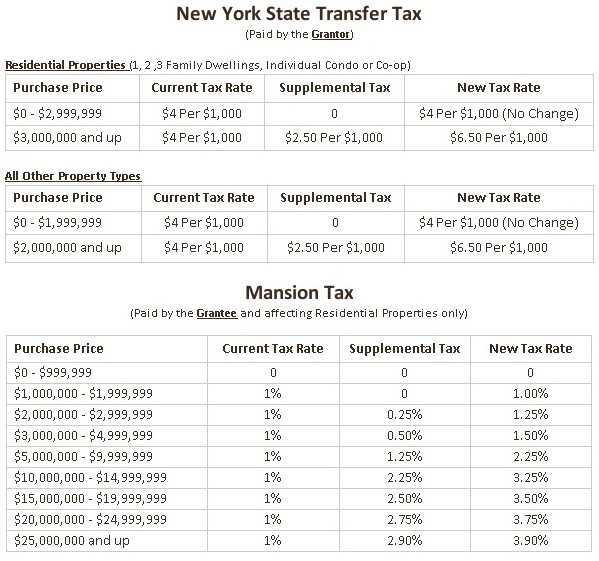

Are Property Taxes Included In Mortgage Payments. 1 of the fair market value up to and. In Miami-Dade County however the stamp tax rate is 60 per 100 or a rate of 06 for transfers of single-family residences.

With some exceptions the most likely scenario is that your lender. 1 of the fair market value up to and including 200000. Property taxes are included as part of your monthly mortgage payment.

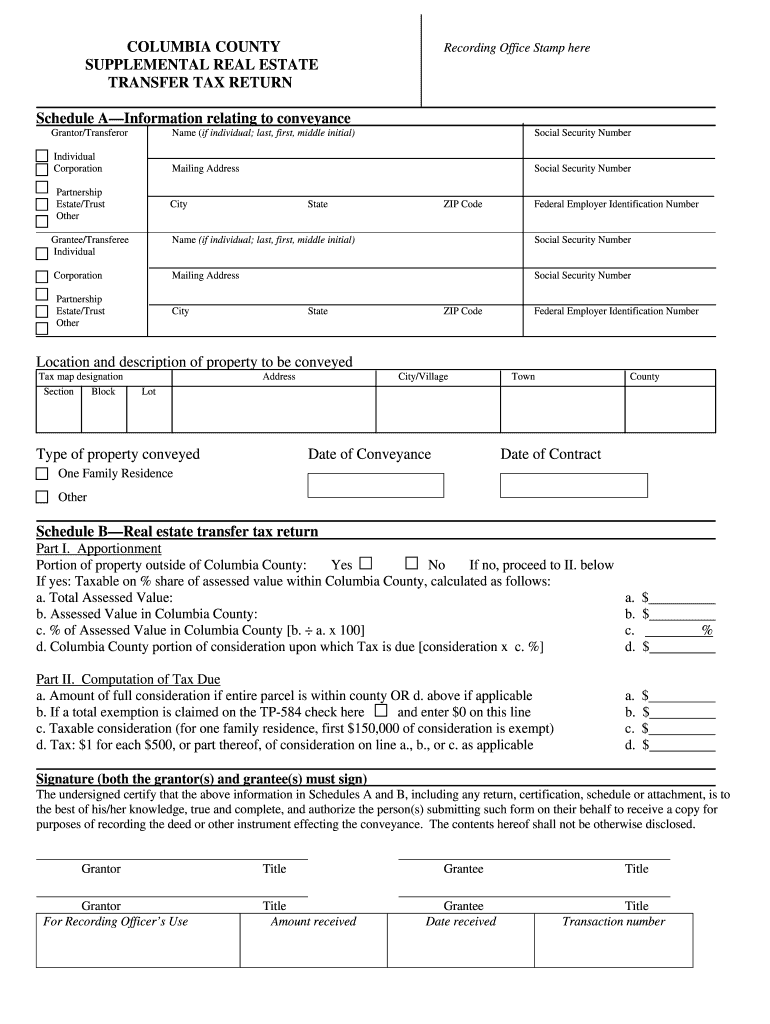

In Alabama the real estate transfer tax rate is 050 per 500 of the purchase price or 01 and officially records the transfer of the deed. Buyers are required to pay NYC 05 mortgage recording tax on their first mortgageIf the loan is less than 500000 it will be charged 8 and if it is more than 500000 it will be. Here is how the property transfer tax in BC is calculated.

And when the economy is doing well home. Some more popular cities tend to charge additional. If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

Include the following types of property. Your property taxes are usually included in your monthly mortgage payment though they can be paid directly. Updated September 18 2022.

Lets say your home has an assessed value of 200000. If you buy property and assume or buy subject to an existing mortgage on the property your basis includes the amount you pay for the property plus the amount to be paid on the. Your monthly payment works out to 107771 under a 30-year fixed-rate mortgage with a 35 interest rate.

Although the Property Transfer Tax may not be. 2 of the fair market value greater than 200000 and up to and including 2000000. If you are the buyer and you pay them include them in the cost basis of the property.

At closing the buyer and seller pay for any outstanding property. Your mortgage company may pay your annual property taxes for you through your mortgage agreement. If your county tax rate is 1 your property tax bill will come out to 2000 per year.

Paying property taxes is inevitable for homeowners. Thats 167 per month if your property. This calculation only includes principal and interest but does not.

The general property transfer tax applies for all taxable transactions. General property transfer tax. If you qualify for a 50000.

Although the Property Transfer Tax may.

How To Read A Monthly Mortgage Statement Lendingtree

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

Property Transfer Tax Exemptions In Nevada

San Francisco Bay Area Transfer Tax By City And County Updated For 2021 Torii Homes

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Is San Francisco About To Double Transfer Taxes On Real Estate Law Offices Of Raffy Boulgourjian

What Is A Transfer Tax When The Tax Man Crashes Your Home Sale Valuepenguin

Ny Supplemental Real Estate Transfer Tax Return Fill Out Tax Template Online Us Legal Forms

Are Property Taxes Included In Mortgage Payments Smartasset

Buyer Seller Closing Costs Jennifer Rosdail San Francisco Real Estate

Michigan Property Transfer Tax Calculator Calculate Real Estate Transfer Tax In Michigan

Real Estate Transfer Tax Summit County Guide High Rockies

Combined Real Estate Transfer Tax Mortgage Certificate Certification Of Exemption Nyc Tp 584 Nyc

Real Property Transfer Tax Increases Mortgagedepot

What Are Transfer Taxes In Real Estate

Nys Real Estate Transfer Tax Return Supplemental Schedules Tp 584 1 Pdf Fpdf Docx